On 13 Dec 2022, the European Banking Authority (EBA) published its roadmap for sustainable finance. The roadmap – a conglomeration of standards and rules aimed at better integrating ESG risk considerations into the banking sector – is set to come into effect in a rolling fashion over the next 3 years.

In our work with leading European banks, clients regularly tell us how they’re starting to build or revamp their ESG data platforms in anticipation of the coming changes around green financing. The conversation typically revolves around how they can flexibly incorporate the many new data sources, types of data, and formats that they will have to ingest and analyze under the EBA’s roadmap of changes.

Clients are also increasingly interested to hear what MongoDB has to offer around real-time ESG information delivery. These inquiries come despite the fact that the EBA didn't yet demand real-time public disclosure and regulatory submissions of sustainability information.

Green lending, green metrics, green data

One interesting area of the EBA roadmap concerns loans with environmental sustainability features, so called green lending. These loans, sometimes called energy efficient or green mortgages, are typically given to retail clients and SMEs to make energy efficient improvements to homes and other buildings, such as adding solar panels or funding other renewable energy work.

According to the roadmap, "... the EBA will consider the merits of an EU definition for green loans and mortgages, and will identify potential measures to encourage their uptake or facilitate their access by retail and SME borrowers…. In line with the request, the EBA will deliver its advice to the European Commission by December 2023."

With the EBA pushing to increase the uptake of green loans, affected banks will have to re-work their scoring criteria for green loans to fit the EBA’s new classification and incentives guidelines:

-

Banks will need to change their green loans credit scoring model to grant "green" retail loans and mortgages.

-

Changes will also likely be required for risk adjusted performance indicators such as RAROC (Risk-Adjusted-Return-on-Capital) which many banks used to quantify the risk-return ratio and other indicators or metrics for pricing and approval decisions. This may result in a change in the acceptance performance of the loans and mortgages.

-

As requested by the European Commission, the changes would not only affect new loans, but also "...already originated loans". Depending on the final advice of EBA, this could potentially mean reassessing existing loans with new data to determine if they can now be classified as “green”. Additionally, a re-assessment of most, if not all the related indicators for risk management and reporting would also need to happen.

All of these potential changes mean banks having to collect more data, from more disparate sources than ever before.

The impact on banks

All these can mean significant impact to the loan origination process and data systems supporting the process.

Here are some questions for banks to think about:

-

Managing evolving or unforeseen changes. How would a bank change their Loan Origination system and related data platform (eg. credit data mart) to quickly adapt to the new green loan taxonomy and data elements? As the standards and classification rules are still evolving, how can one design an application and data schema that will still assure the development team that they easily adapt without throwing away existing work?

-

Capturing different data attributes for the same product/loan. How can banks take existing retail loan products or mortgages and integrate different assessment criteria such as country specific regulations within EU and outside of the EU? How about incorporating specific market/business practices within a country, such as a car loan, which can vary based on the type of car (Battery electric vehicles, vs hybrid, vs gas powered).

-

Incorporating new data types and formats. How can one capture information that goes beyond traditional financial credit data, including new data for both green classifications and green risk assessments? In the ECB’s 2022 climate risk stress testing, the ECB already gave a preview that geospatial data will be required to assess loan risks. How can banks add geo-location data and perform queries and analytics in a co-existent and seamless manner with the other existing data on their existing data platform? How about incorporating a whole raft of new unstructured sources, such as text description (emails, collateral documentation) that contains required ESG or sustainability characteristics to correctly classify the loan, for instance carbon emission descriptions of the house under mortgage.

-

Finding insights from data explosion. With the increasing volume and variety of data sources, how can the borrowers quickly find the information (such as guidelines and related product information or ESG related guidance to obtain the relevant data) needed to correctly submit all the required loan information? Can potential borrowers type in "green car loan" and the lending bank’s web site or mobile app return immediately the relevant information for the potential customer? How can green loan credit officers quickly search for borrowers pending approval that have textual collateral information or certain risk information, matching keywords related to new risk findings that change the risk decision?

-

Meeting the demands of customers, and the competition. Will the bank’s loan origination systems be able to provide a sustainability risk-adjusted credit score in real-time for in-principle approvals? Will that system scale to keep up with the demand caused by a large volume of retail borrowers?

How MongoDB can help

Loan origination, including post-origination monitoring, requires a large system with multiple modules and corresponding internal user groups such as loan application and data capture, data enrichment, financial risk analytics, decision and approvals, and loan closure.

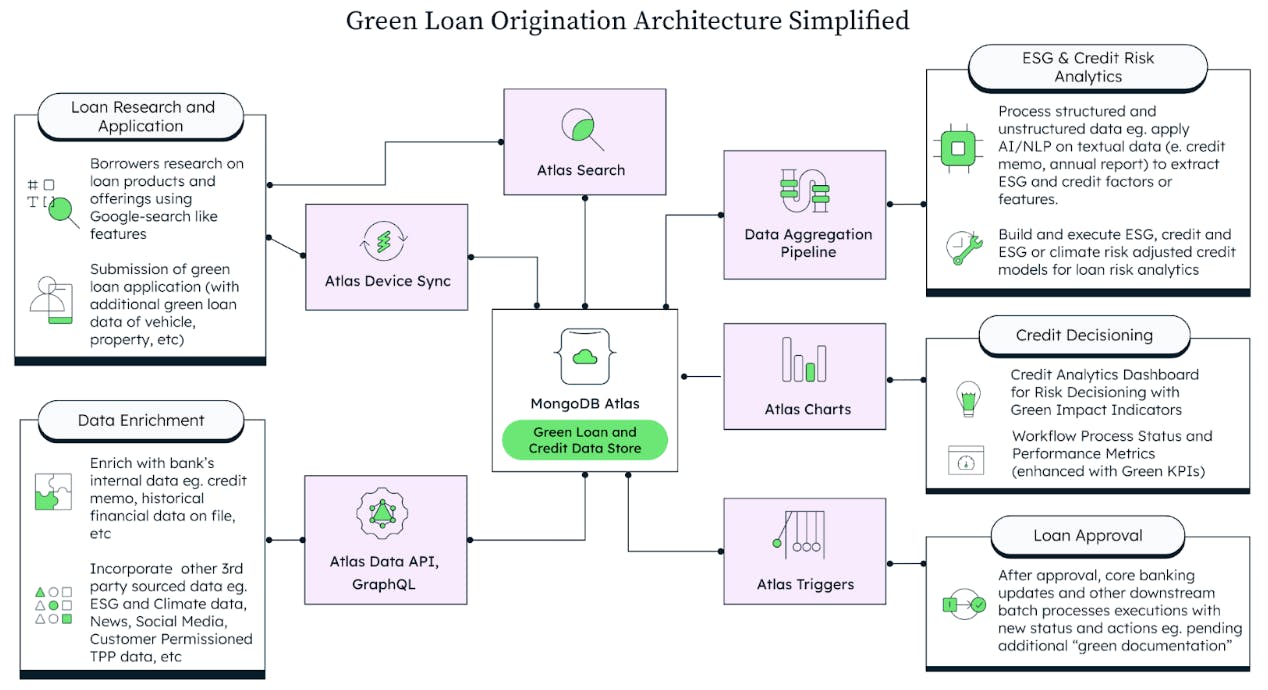

There are many ways a bank can architect or revise its loan origination and monitoring systems. Here is a simplified architecture with MongoDB for a green loan origination system built to service the EBA’s proposed green loan changes.

Clik here to view.

A few key features of using MongoDB Atlas:

-

Atlas Device Sync can automatically synchronize MongoDB's mobile database Realm, deployed on the mobile devices of users, back to Atlas. Borrowers (or even loan officers) who need to submit or review a large set of documents can access the documents faster with the offline-first Realm mobile database. The use of Realm and Device Sync also speeds up mobile development and alleviates the need to maintain complex data synchronization logic.

-

Atlas Search is an embedded, full-text search in MongoDB Atlas that gives you a seamless, scalable experience for building relevance-based app features. Built on Apache Lucene, Atlas Search eliminates the need to run a separate search system alongside your database. Combined with Altas Search facet, users can quickly narrow down Atlas Search results based on the most frequent attribute values in the specified attribute field.

-

Atlas Data API and GraphQL – MongoDB Atlas provides a low-code/no-code approach for developers to quickly develop APIs for other internal or even external applications (like Third-Party Providers (TPPs) in an Open Banking ecosystem) to access data in a secure manner. MongoDB supports the use of GraphQL, a query language for API development designed to let developers construct requests that pull data from multiple data sources in a single API call. This helps eliminate over-fetching problems and circumvents the need for multiple costly round trips to the server. The ease of building data access and reduction of performance roundtrip, helps banks accelerate business with TPPs in an open banking ecosystem, improving the customer experience either with direct access to the bank's mobile applications, or those of a TPP.

-

Data Aggregation Pipeline is a framework for data aggregation, modeled on the concept of data processing pipelines. Documents enter a multi-stage pipeline that transforms them into aggregated results. This allows bank development teams to quickly implement data analytics in a natural sequence of data processing units, rather than needing to use multiple nesting SQL statements. This framework is the cornerstone of providing the high performance transanalytics capabilities that MongoDB is known for. Banks can develop both real-time on-the-fly ESG-adjusted credit scoring and also batch analytics processing required as part of the loan origination process.

-

Atlas Charts is a data visualization tool built into Atlas. It provides a clear understanding of your data, highlighting correlations between variables and making it easy to discern patterns and trends within your dataset. The Charts API allows banks to build in-app business intelligence with a variety of analytics tools to help both the borrowers and the bank to gain more insights into the loan. ESG vendors have used MongoDB to help their Fortune 500 customers to improve their ESG performance. For retail loans where the ESG complexity or green requirements should be a lot less complicated, the self-service analytics that Charts can provide would help to accelerate green retail loan processing even more.

-

Atlas Triggers allow you to execute server-side logic in response to database events or according to a schedule. Triggers can respond to events or use pre-defined schedules. Triggers can be combined with many other integration features, such as the Data API mentioned above, to perform the necessary actions for the loan workflow. No task would be missed or remain unprocessed!

Offer Green Loans with MongoDB

One of the questions I am asked by peers in risk management is, “Why would ESG be relevant to retail loans?”. Such a question makes me suspect that there is still a lack of understanding around the relevance of ESG, sustainability and climate risk to those who may be working in ESG but not in retail lending business.

The EBA's roadmap clearly indicates that there is a need to not just require sustainability to be incorporated in retail loans and green mortgages, but also to develop standards and guidelines to support that. This EBA sustainable finance roadmap clarifies, consolidates, and expands on earlier plans and should help financial institutions impacted to be more prepared for the wave of changes coming in ESG and sustainability financing.

Both business and technology teams should start thinking about how to adapt for these evolving requirements and newly forming standards, whether they are in a market directly impacted by the EBA’s roadmap, or in one that will be influenced by these new standards. Afterall, EU regulation is often referenced and / or adopted by regulators in other countries and regions.