Banking used to be a somewhat staid, hyper-conservative industry, seemingly evolving over eons. But banking in recent years has dramatically changed. Under pressure from demanding consumers and nimble new competitors, development cycles measured in years are no longer sufficient in a market expecting new products, such as Buy-Now-Pay-Later, to be introduced within months or even weeks.

Just ask Temenos, the world's largest financial services application provider, providing banking for more than 1.2 billion people. Temenos is leading the way in banking software innovation and offers a seamless experience for their client community. Financial institutions can embed Temenos components, which delivers new functionality in their existing on-premises environments (or in their own environment in their cloud deployments) or through a full banking as a service experience with Temenos T365 powered by MongoDB on various cloud platforms. Temenos embraces a cloud-first, microservices-based infrastructure built with MongoDB, giving customers flexibility, while also delivering significant performance improvements. This new MongoDB-based infrastructure enables Temenos to rapidly innovate on its customers' behalf, while improving security, performance, and scalability.

Architecting for a better banking future

Banking solutions often have a life cycle of 10 or more years, and some systems I am involved in upgrading date back to the 1980s. Upgrades and changes, often focussed on regulatory or technical upgrades (for example, operating system versions), hardware upgrades, and new functionality, are bolted on.

The fast pace of innovation, a mobile-first world, competition, crypto, and Defi are demanding a massive change for the banking industry, too. The definition of new products and roll outs measured in weeks and months versus years requires an equally drastic change in technology adoption.

Banking is following a path similar to the retail industry. Retail was built upon a static design approach with monolithic applications connected through ETL (Extract, Transform, and Load) and “unloading of data,” that was robust and built for the times. The accelerated move to omnichannel requirements brought a component-driven architecture design to fruition that allowed faster innovation and fit-for-purpose components being added (or discarded) from a solution. The codification of this is called MACH (Microservices, API first, Cloud-native, and Headless) and a great example is the flexibility brought to bear through companies such as Commercetools.

Temenos is taking the same direction for banking. Its concept of components that are seamlessly added to existing Temenos Transact implementations empowers banks to start an evolutionary journey from existing status on-premises environments to a flexible hybrid landscape delivering best of breed banking experiences. Key for this journey is a flexible data concept that meshes the existing environments with requirements of fast changing components available on premises and in the cloud.

Temenos and MongoDB joined forces in 2019 to investigate the path toward data in a componentized world. Over the past few years, our teams have collaborated on a number of new, innovative component services to enhance the Temenos product family, and several banking clients are now using those components in production. However, the approach we've taken allows banks to upgrade on their own terms. By putting components “in front” of the Temenos Transact platform, banks can start using a componentization solution without disrupting their ability to serve existing customer requirements. Similarly, Temenos offers MongoDB's critical data infrastructure with an array of deployment capabilities, from full-service multi- or hybrid cloud offerings, to on-premises self-managed, depending on local regulations and the client’s risk appetite.

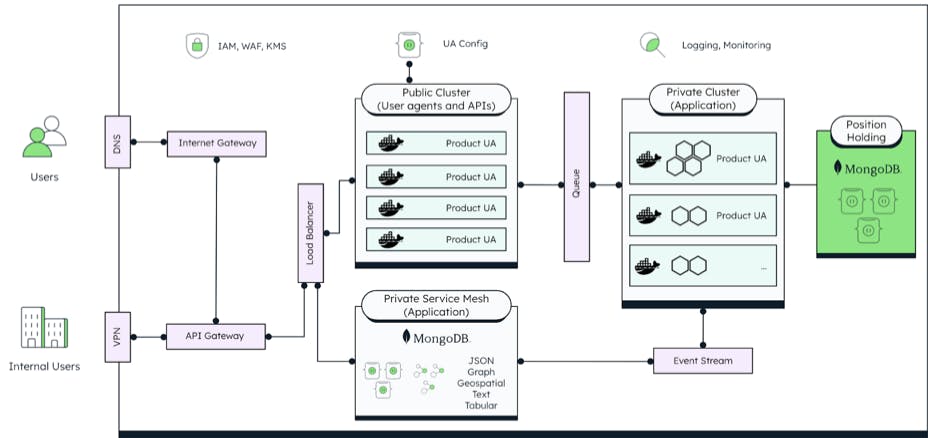

In these and other ways, Temenos makes it easier for its banking clients to embrace the future without upsetting existing investments. From an architectural perspective, this is how component services utilize the new event system of Temenos Transact and enable a new way of operating:

Clik here to view.

Improved performance and scale

All of which may sound great, but you may still be wondering whether this combination of MongoDB and Temenos Transact can deliver the high throughput needed by Tier 1 banks. Based on extensive testing and benchmarking, the answer is a resounding yes. Having been in the benchmark business for a long time, I know that you should never trust just ANY benchmark. (In fact, my colleague, MongoDB distinguished engineer John Page, wrote a great blog post about how to benchmark a database.)

But Temenos, MongoDB, and AWS jointly felt the need to remove this nagging itch and deliver a true statement on performance, delivering proof of a superior solution for the client community. Starting with the goal of reaching a throughput of 25,000 transactions, it quickly became obvious that this rather conservative goal could easily be smashed, so we decided to quadruple the number to 100,000 transactions using a more elaborate environment. The newly improved version of Temenos Transact in conjunction with component services proved to be a performance giant.

One hundred thousand financial transactions per second with a MongoDB response time under 1ms was a major milestone compared to earlier benchmarks with 79ms response time with Oracle, for example. Naturally, this result is in large part due to the improved component behavior and the AWS Lambda functions that now run the business functionality, but the document model of MongoDB in conjunction with the idiomatic driver concept has proven superior over the outdated relational engine of the legacy systems.

Below, I have included some details from the benchmark. As Page once said, “You should never accept single benchmark numbers at face value without knowing the exact environment they were achieved in.”

Configuration:

| J-meter Scripts | Number of Balance Services | Number of Transact Services | MongoDB Atlas Cluster | Number of Docs in Balance | Number of Docs in Transaction |

|---|---|---|---|---|---|

| 3 | 6 GetBalance - 4 GetTransactions - 2 |

4 | M80 (2TB) | 110M | 200M |

Test Results

| Functional TPS | API Latency ms | DB Latency ms | |

|---|---|---|---|

| Get Balance | 46751 | 79.45 | 0.36 |

| Get Transaction | 22340 | 16.58 | 0.36 |

| Transact Service | 31702 | 117.15 | 1.07 |

| Total | 100793 | 71.067 | 0.715 |

The underlying environment consists of 200-million accounts with 100-million customers, which shows the scalability the configuration is capable of working with. This setup would be suitable for the largest Tier 1 banking organizations.

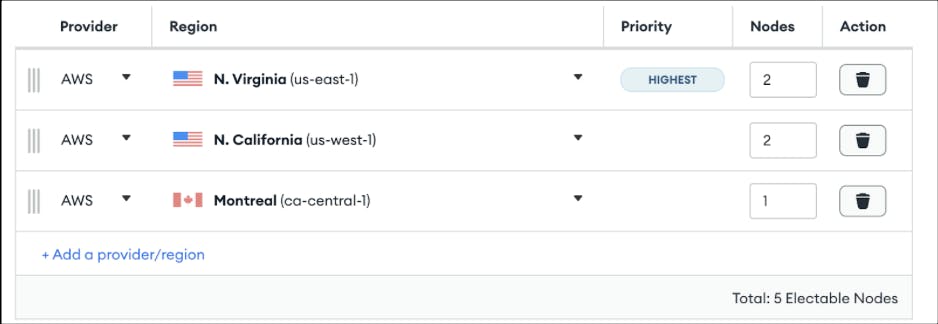

The well-versed MongoDB user will realize that the used cluster configuration for MongoDB is small. The M80 cluster, 32 VCores with 128GB RAM, is configured with 5 nodes. Many banking clients prefer those larger 5-node configurations for higher availability protection and better read distribution over multiple AWS Availability Zones and regions, which would improve the performance even more. In the case of an Availability Zone outage or even a regional outage, the MongoDB Atlas platform will continue to service via the additional region as back up. The low latency shows that the MongoDB Atlas M80 was not even fully utilized during the benchmark.

Clik here to view.

The diagram shows a typical configuration for such a cluster setup for the American market: one East Coast location, one West Coast location, and an additional node out of both regions in Canada. MongoDB Atlas allows the creation of such a cluster within seconds configured to the specific requirements of the solution deployed.

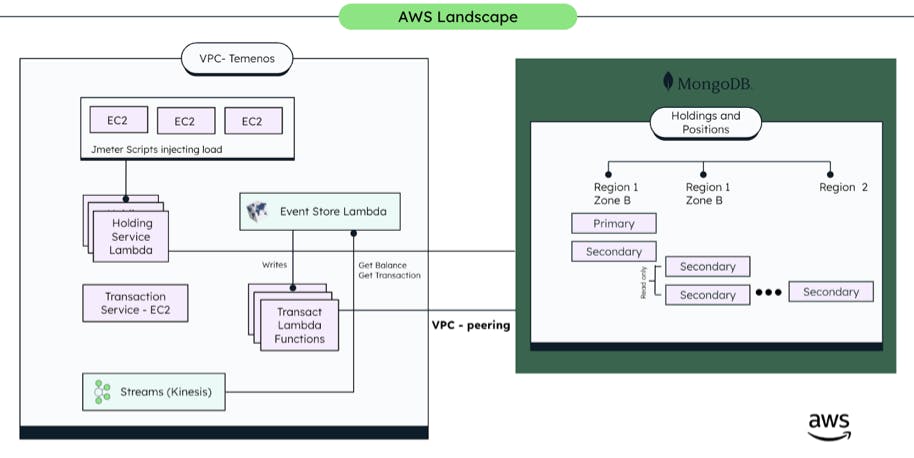

The total landscape is shown in the following diagram:

Clik here to view.

Signed, sealed, and delivered. This benchmark should give clients peace of mind that the combination of core banking with Temenos Transact and MongoDB is indeed ready for prime time.

While thousands of banks rely on MongoDB for many parts of their operations ranging from login management and online banking, to risk and treasury management systems, Temenos' adoption of MongoDB is a milestone. It shows that there is significant value in moving from a legacy database technology to the innovative MongoDB application data platform, allowing faster innovation, eliminating technical debt along the way, and simplifying the landscape for financial institutions, their software vendors, and service providers.

If you would like to learn more about MongoDB in the financial services industry, take a look at our guide: The Road to Smart Banking: A Guide to Moving from Mainframe to Data Mesh and Data-as-a-Product